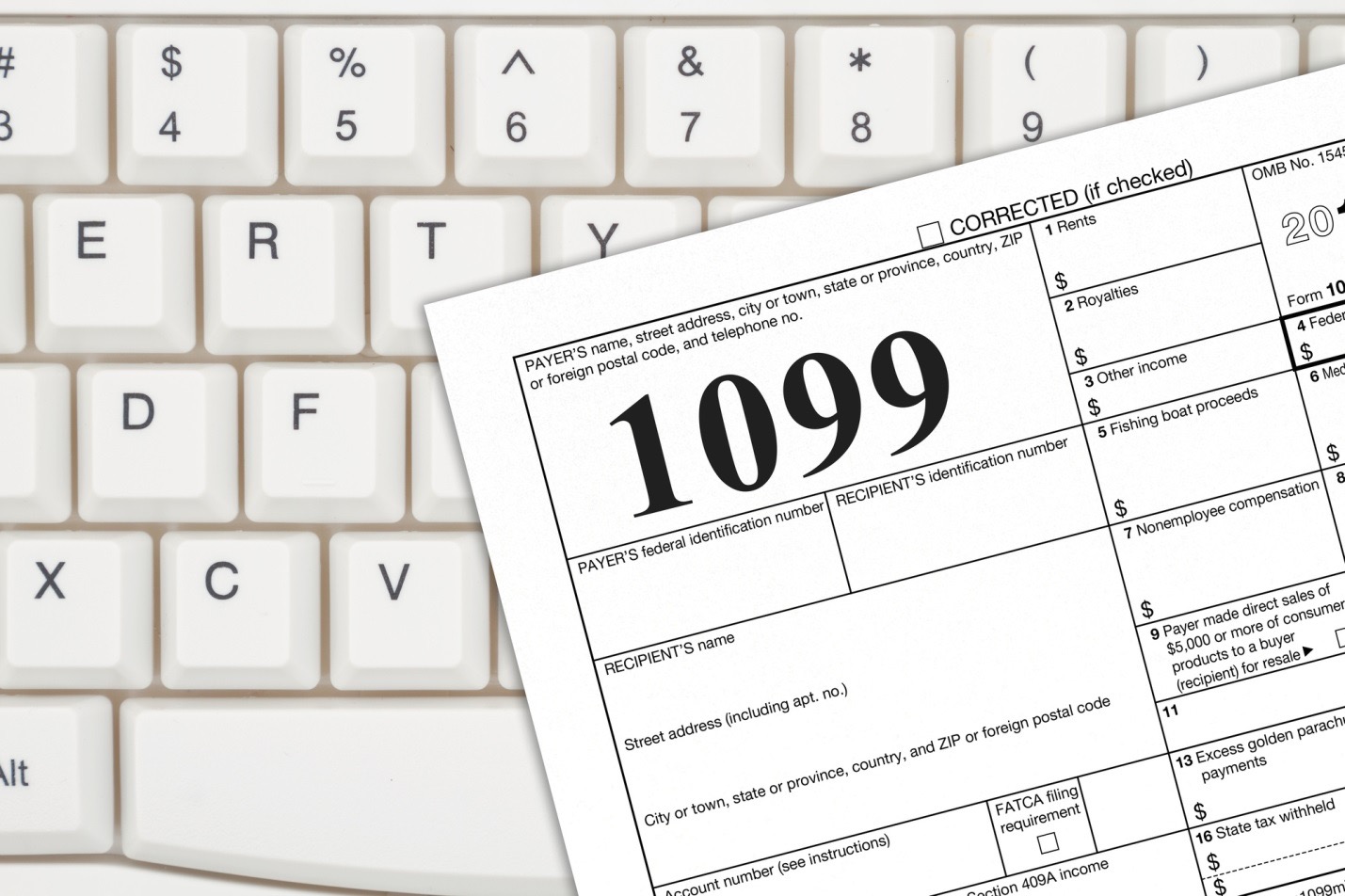

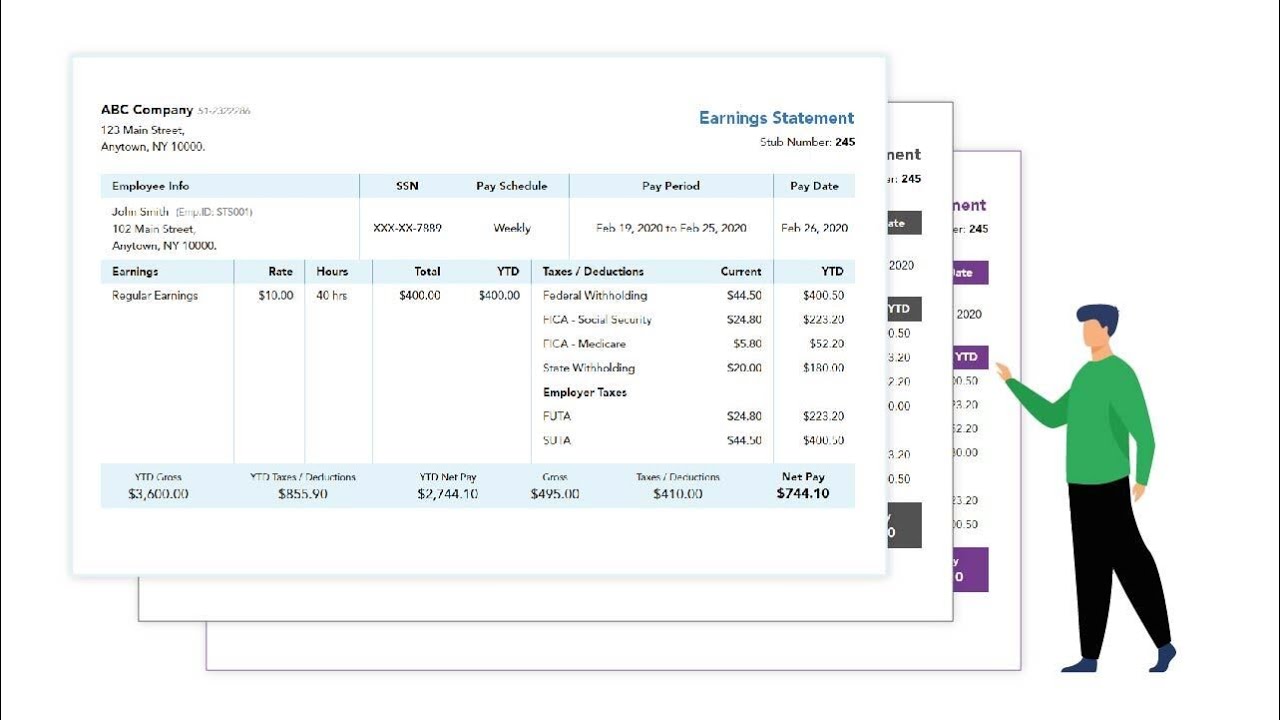

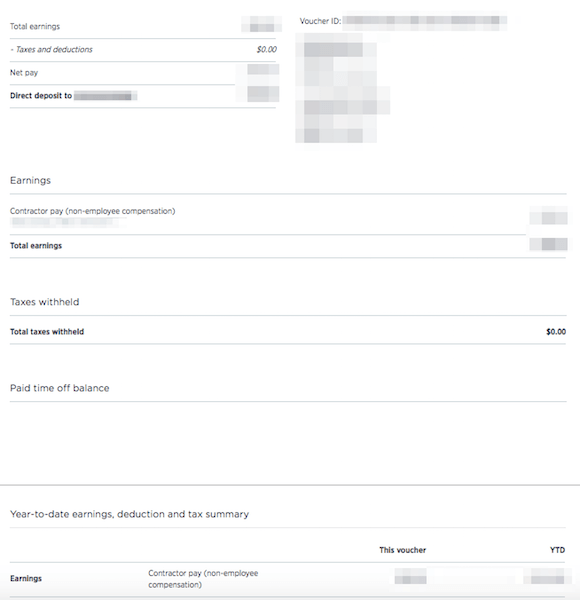

The last thing you want to do is to produce a pay stub that is not accurate, after all Creating a 1099 Pay Stub Proof of income is an important element of any major adult transaction If you're a selfemployed individual, you'll need to find a way to create this proof The above instructions on creating a 1099 pay stub can help immenselyFill in the required company, employee, earnings, and pay schedule information Choose the template you prefer, preview paystub, and make corrections if required Download and print paystub instantly or email it directly to your employee or contractor Generate pay stubs with accurate tax calculationsAny nonemployee who you might pay $600 or more in a given year (although electronic payments, such as with a credit card, don't count) Before you start, check the IRS guidelines so you know who you need to file 1099s for Note 1099 EFile Service only supports contractors with addresses in the United States

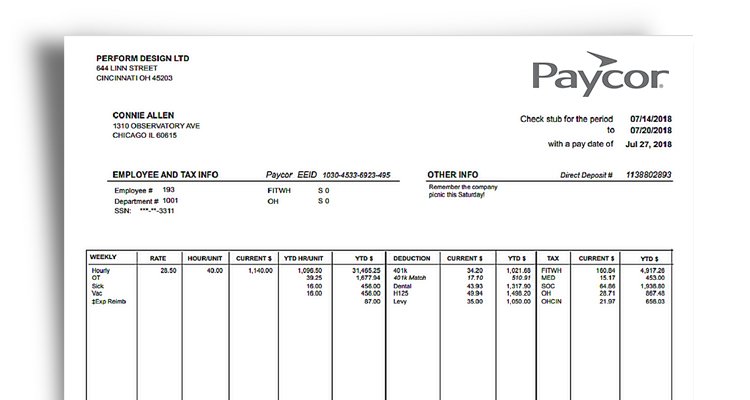

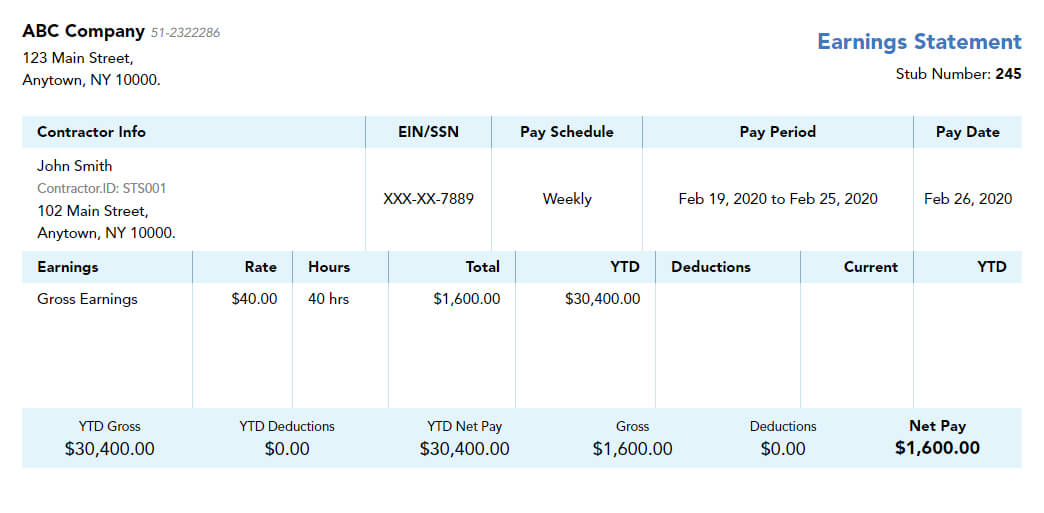

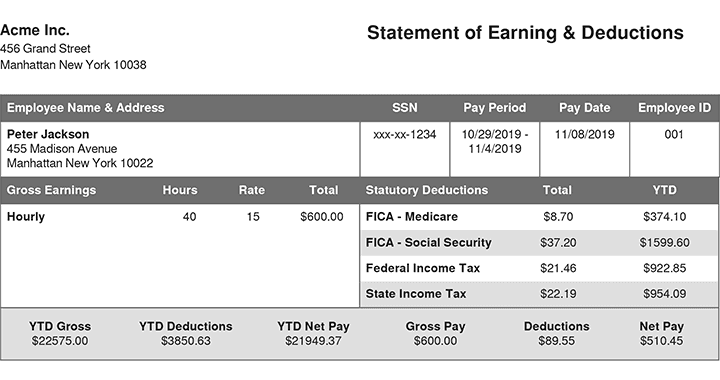

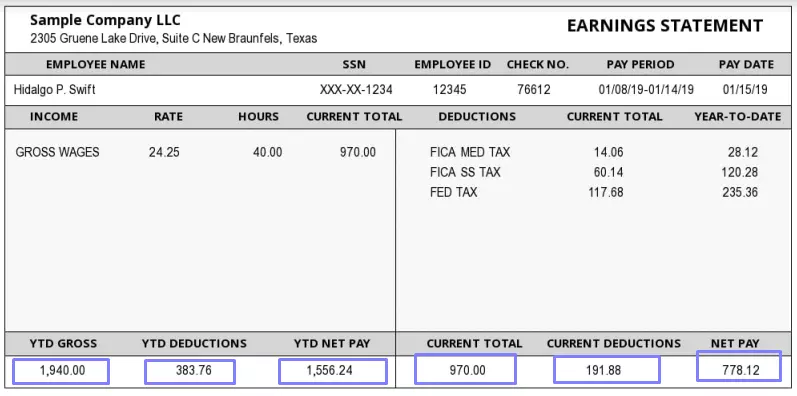

Pay Stub Example See What S Included

Check stubs for 1099 employee

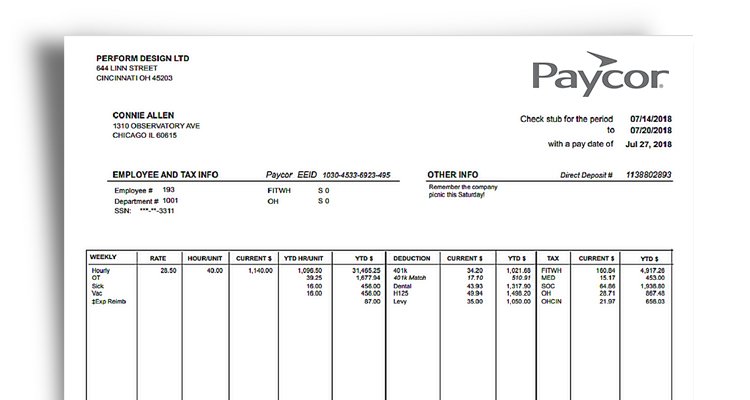

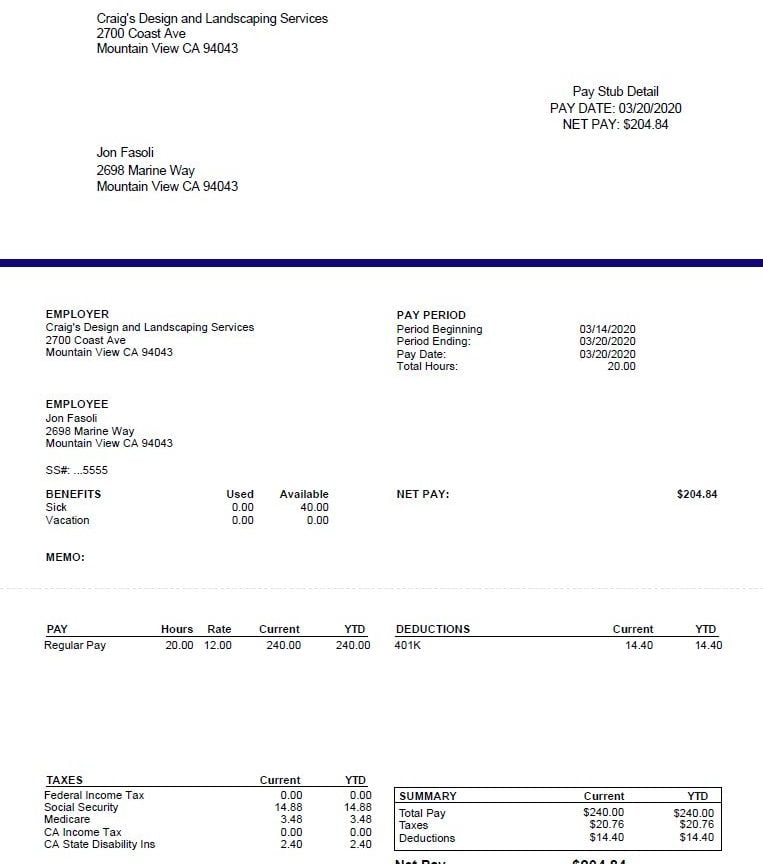

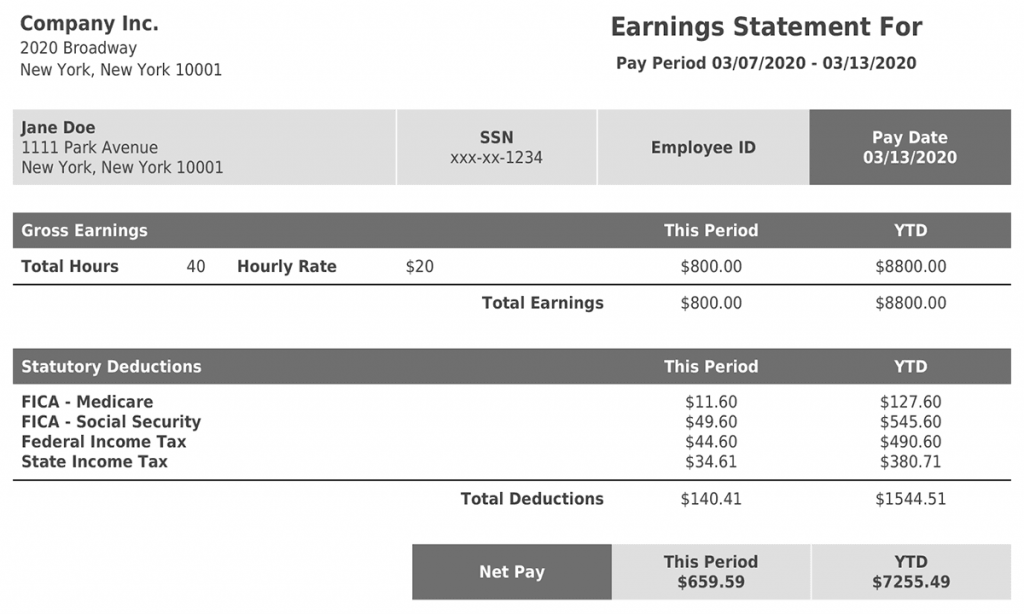

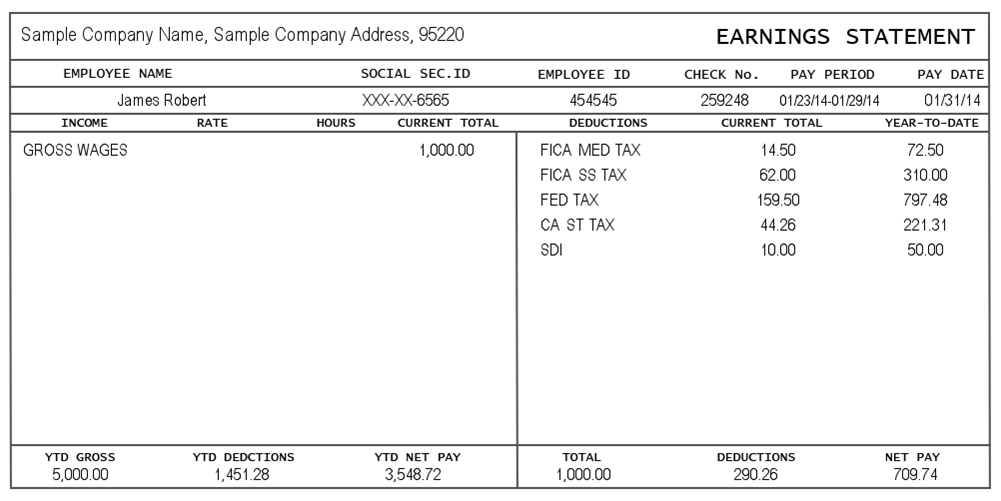

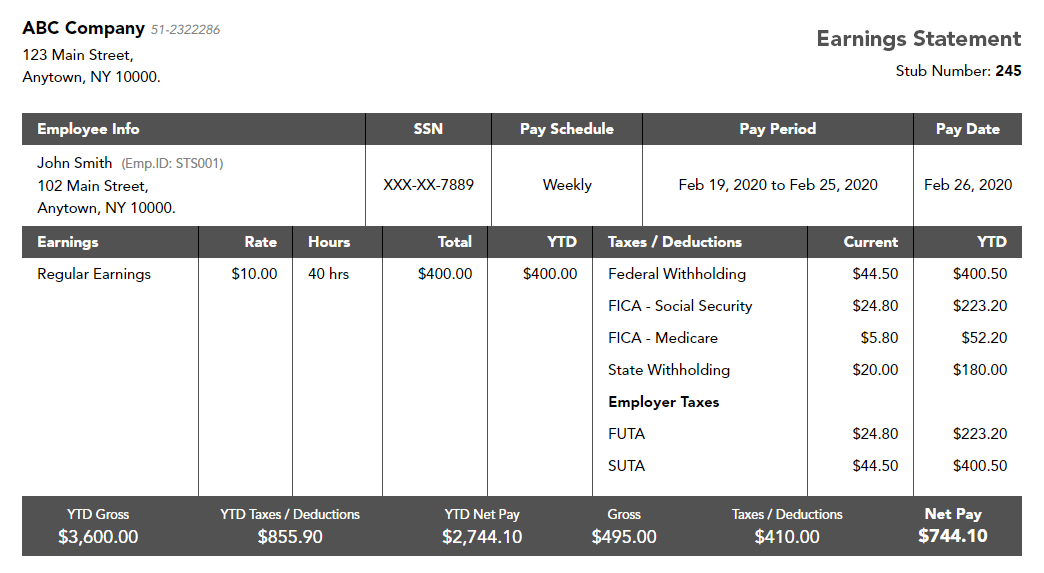

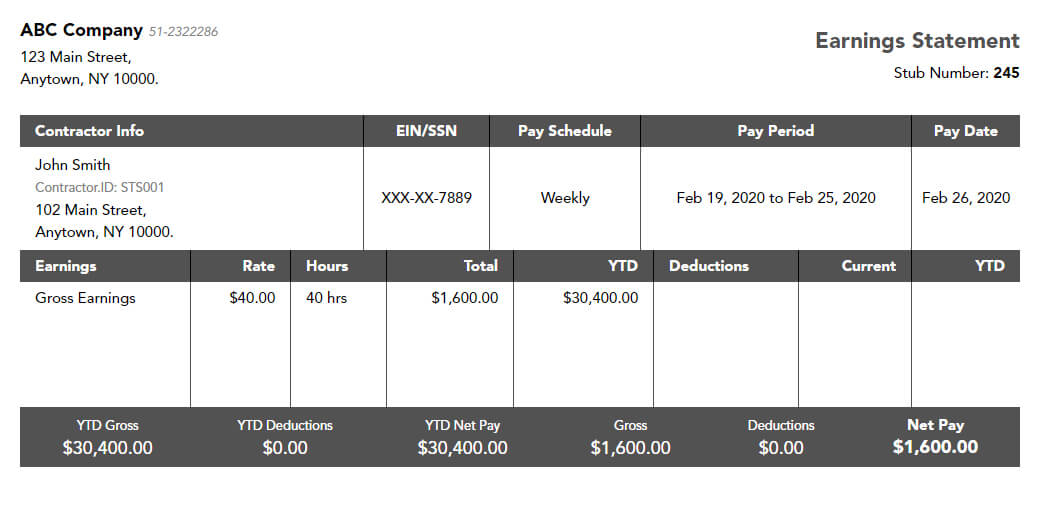

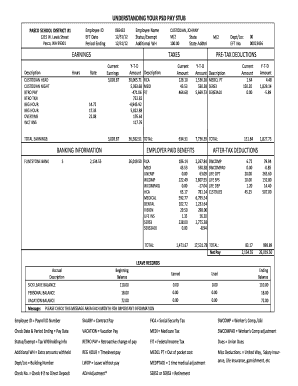

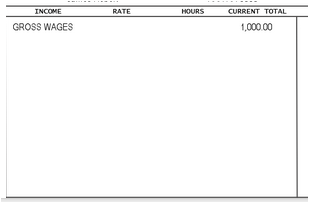

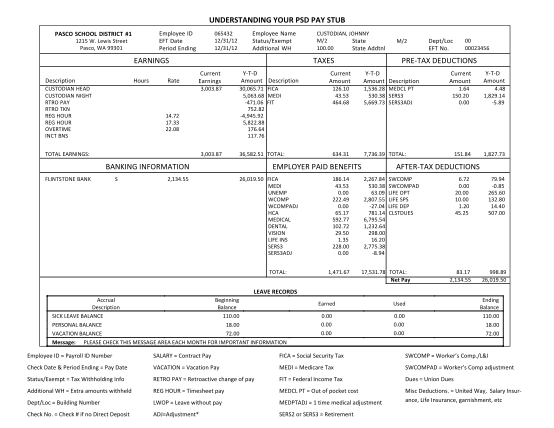

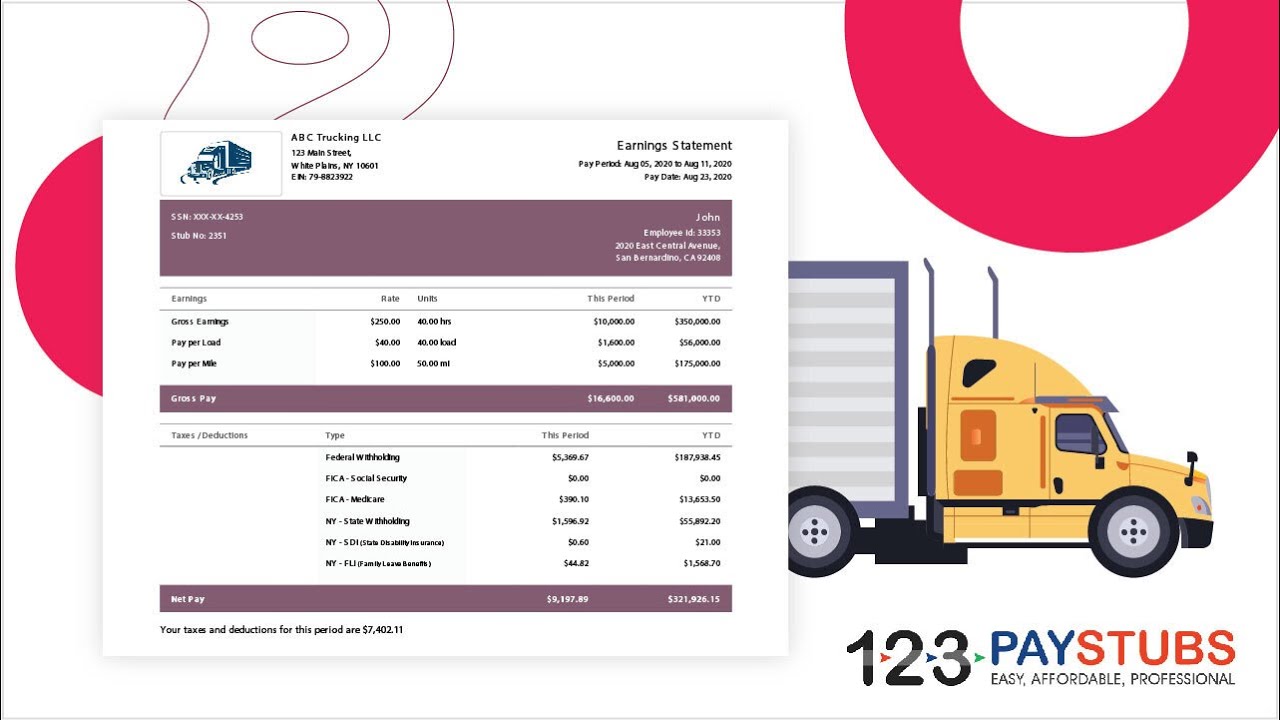

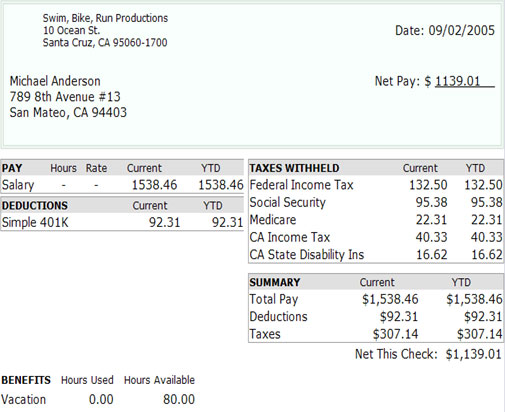

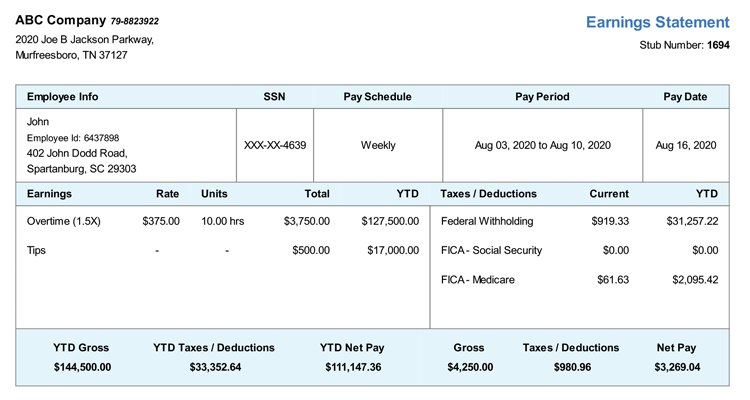

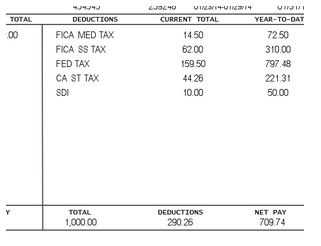

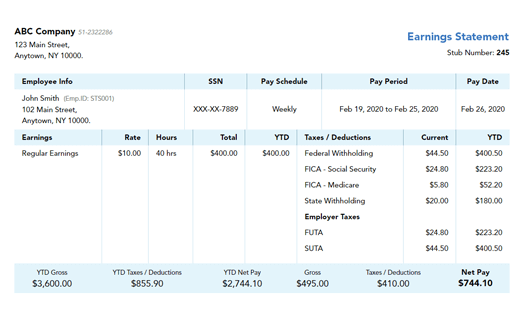

Check stubs for 1099 employee-Whether an employee receives paychecks via direct deposit, physical check, or payroll card, a pay stub is typically provided as documentation of payment received A pay stub may show the amount earned for the immediate pay period as well as total yeartodate earningsA pay stub can help the contractor verify that the dollar amount on the 1099 is correct If Acme Manufacturing pays you $5,000 for contracting work in , that dollar amount should be listed on the 1099, and on the yearend pay stub

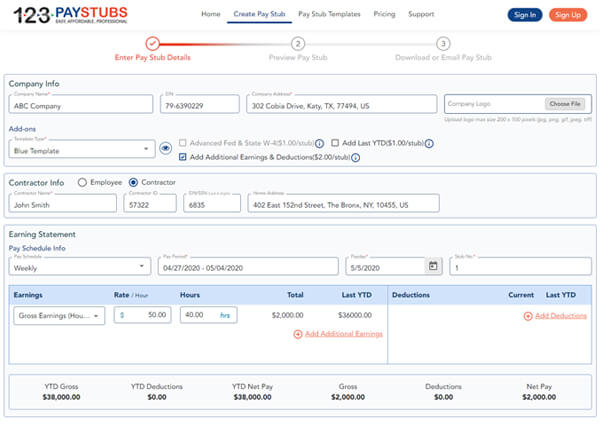

How To Generate Pay Stub For 1099 Independent Contractors Tech Moths

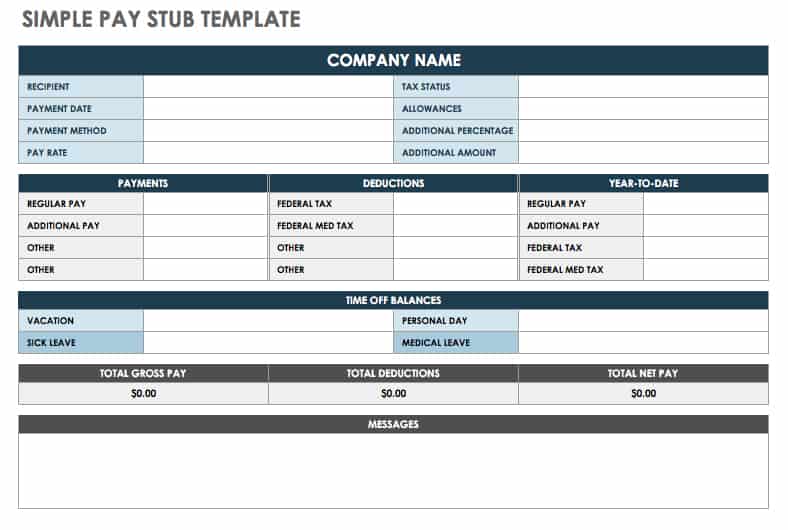

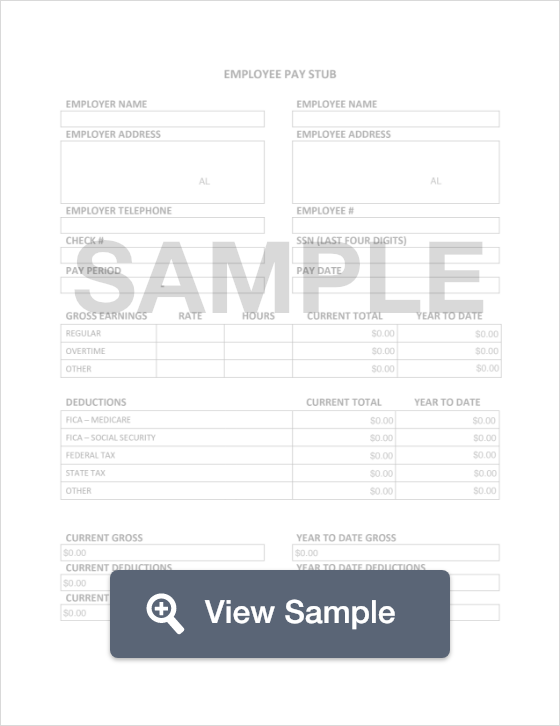

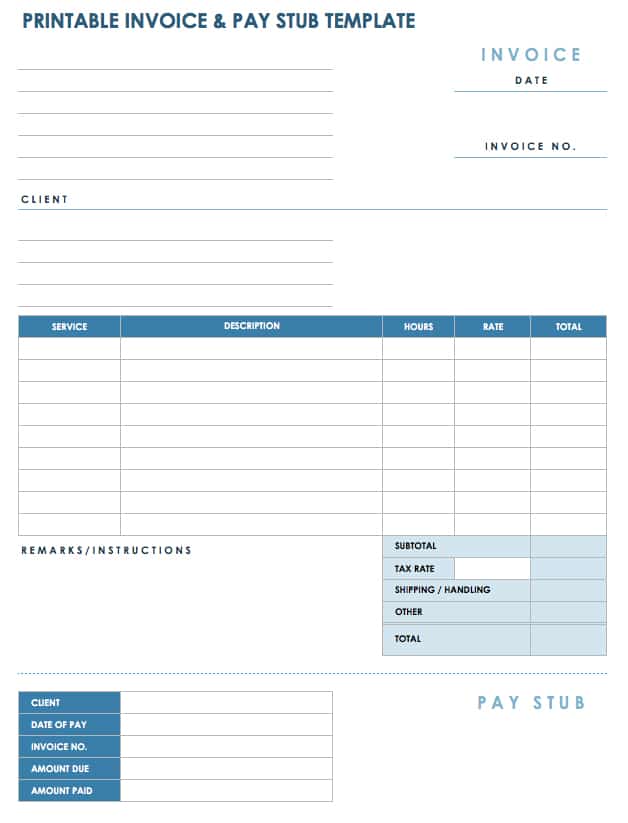

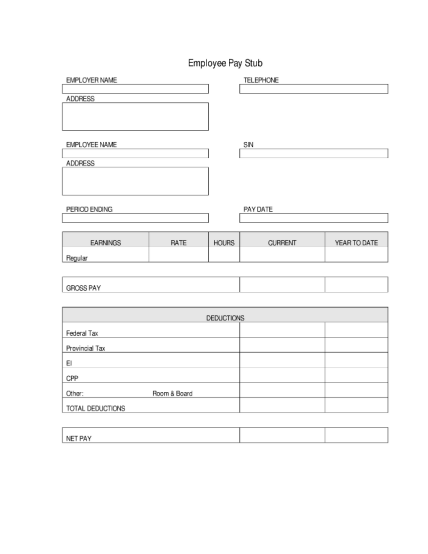

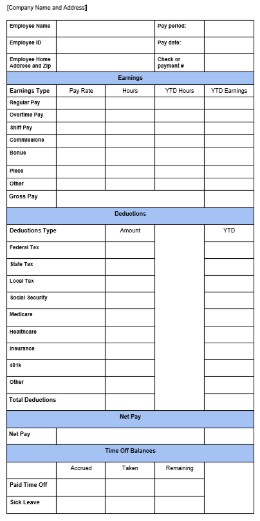

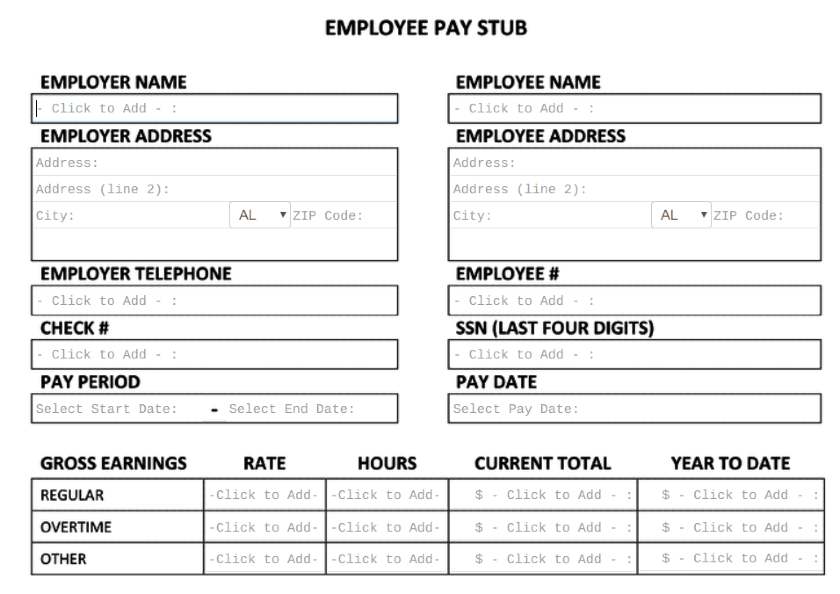

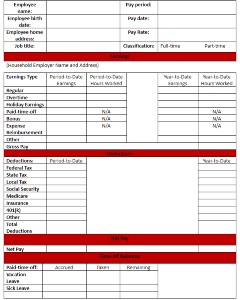

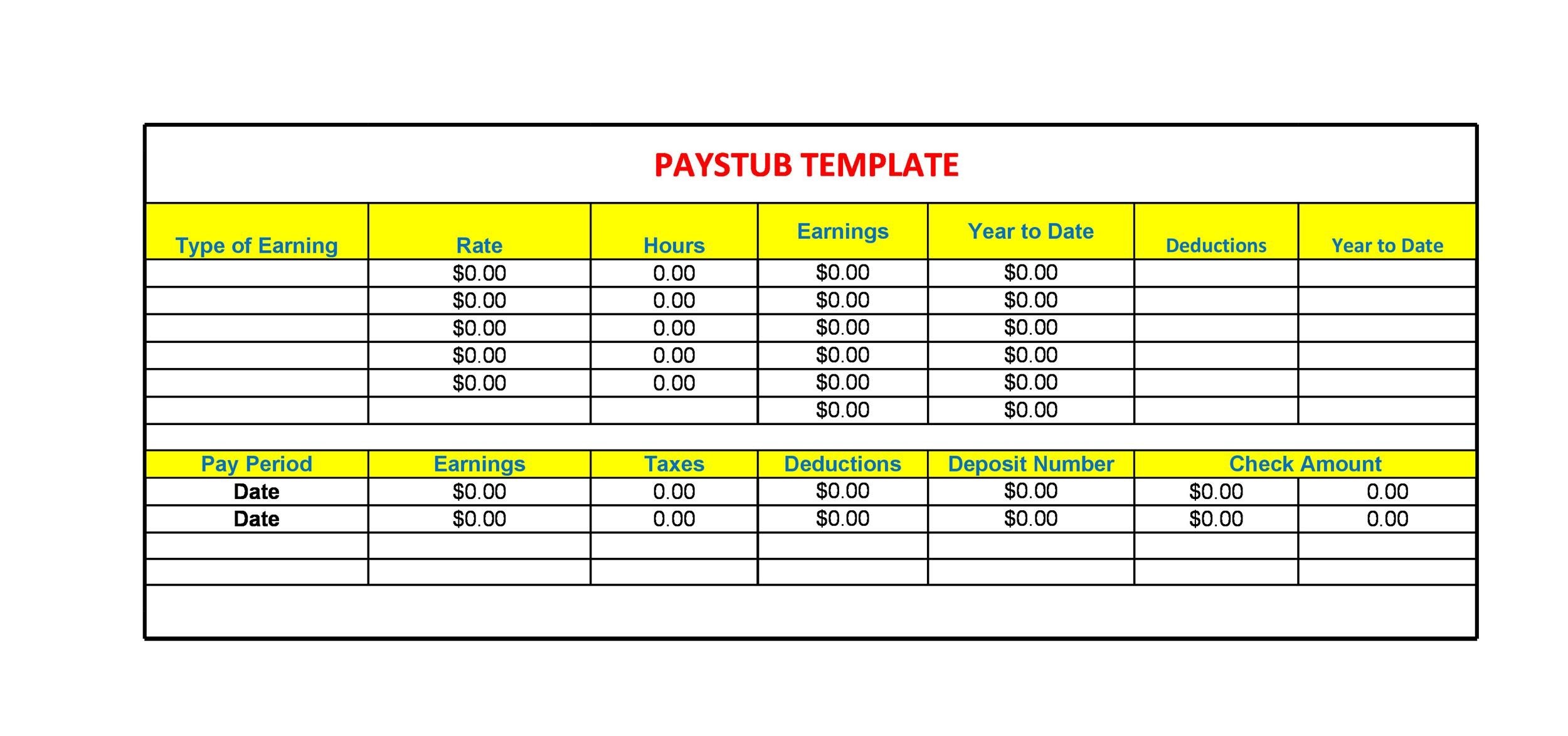

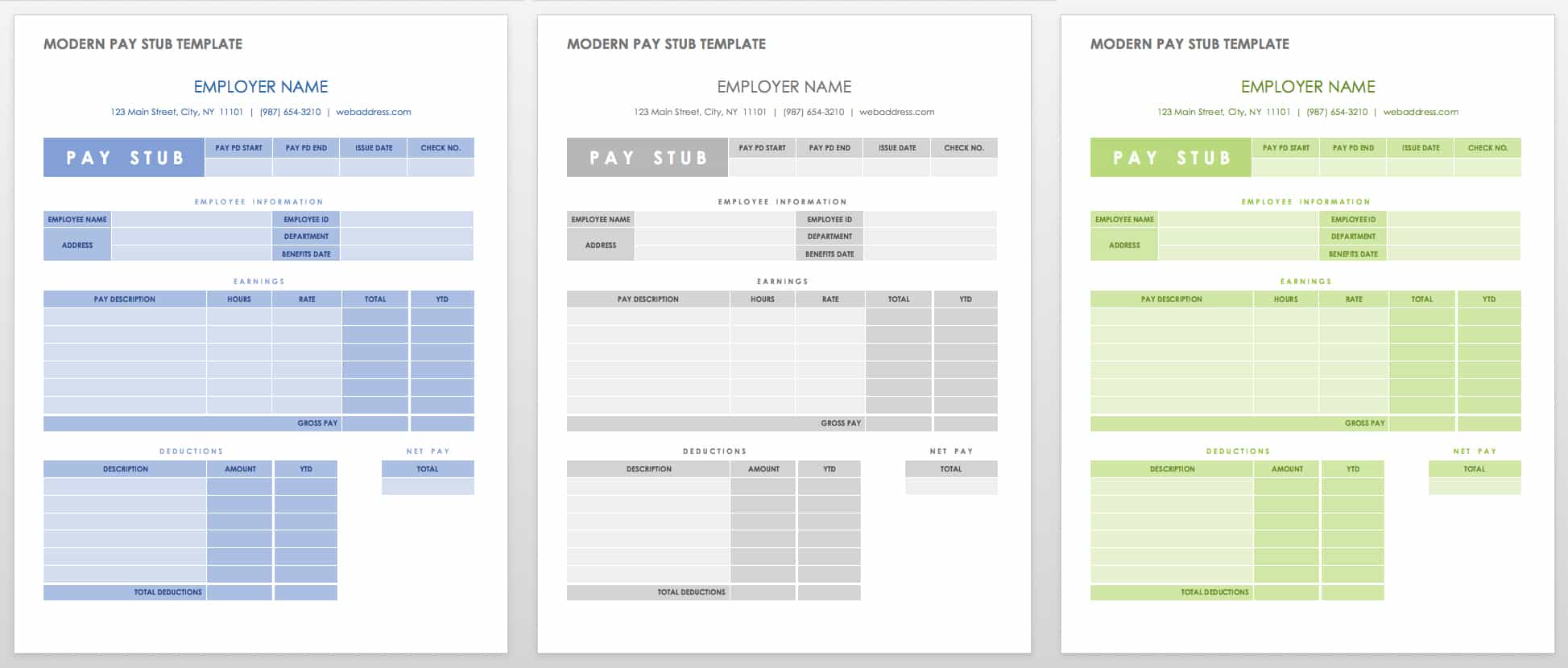

Paycheck stub makers are fast and easy Perfect for small businesses or freelancers looking to have reliable pay stub generating options Our online check stub maker makes it easy for employees or independent contractors to print their paystubs online Paystubsnow is the best pay stub generator and we make it easy to generate paystubsFree Paycheck Stub Template Free Pay Stub Templates are available with Stub Creator which is ready to download and use Free check stub templates give you a clear idea of the exact format you will receive in generated pay stub As you get the freedom to choose the template of your choice, you can choose the format in which your employees will receive the stubA paystub, paycheque, check stub, or paycheck stub are all referring to the same thing A pay stub is simply proof of income given by your employer It is a piece of paper that lists and itemizes your work hours, your wages/salary, as well as your deductions, YTD gross and YTD total

Here's a note about pay stubs If you are an employee of a company, it is a good practice to check your pay stub to ensure you are paid correctly Since the Family Day stat holiday just passed, please review your pay stub for accuracy, never assume your employer calculated your stat pay properly #statpay #statholidaypay #paystubs #Paystubs Create your own instant Pay Stub with our Pay Stub Maker Instantly only requires some basic information related to your employment1099 Independent Contractor Pay Stub Templates 123PayStubs offers a variety of professional 1099 pay stub templates for both the employees and contractors in different styles and designs You can choose from any pay stub samples to generate a pay stub for your 1099 contractors And the best part is all the paystub templates are free

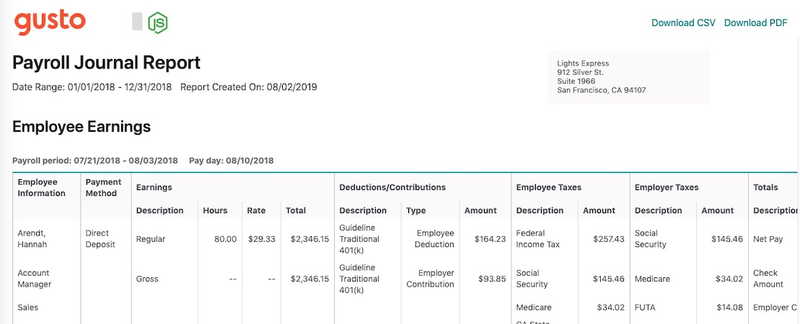

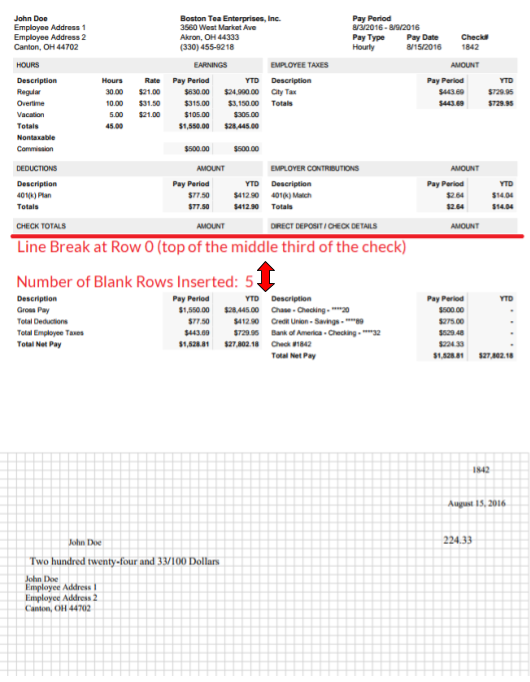

While a 1099 pay stub is not required, it is still a good way to help you keep track of where your money is going Most accountants would recommend that you use them either for your independent contractors or for yourselfThe pay stub generator creates a pay stub in four easy steps 1 Enter the company, employee, and income information 2 Enter any applicable deductions 3 Click on the "Create pay stub" button 4 Check your email Your pay stub is ready and waiting for youUse payroll stub templates to conveniently generate detailed pay stubs for each of your employees Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats Free Microsoft Excel payroll templates and timesheet templates are the most costeffective means for meeting your back office needs

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

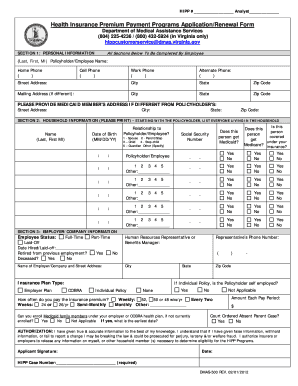

Fillable Pay Stub Fill Online Printable Fillable Blank Pdffiller

Welcome to pay stub creator Completely all pay stubs free till the 31st December 21 A simple way to make 100% FREE paycheck stubs online, we are US based company, other than us, no one providing free pay stubs CREATE Home Read More »Thirdly, our check paystub maker is an allinone tool for freelancers as well as employees in your budget as one paystub costs only $399 Finally, you'll swear by our 24*7 customer support facility that makes our paystub maker so wantedOnline salary slip maker Reak Check Stubs with its array of features such as its pay stub template for 1099 employees and employee payroll calculator could give you a huge advantage when it comes to making your job of issuing pay stubs easier They are one of the musthave tools in a business owner's arsenal to give him or her the edge when it comes to dealing

Free Pay Stub Templates Smartsheet

2

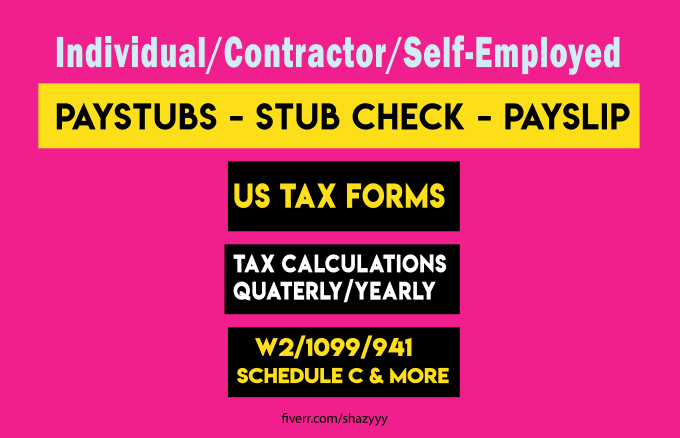

For only $10, Joshuababashola will prepare your employee w2 1099 check stub in 1 hour Welcome to my gig!!!The law around paystubs is really murky at best Federal law has nothing stating that employers are required to provide pay stubs to their employees and independent contractors They are required to provide end of year forms like a W2 form and a 1099MISC if employees and contractors are paid more than $600 during the yearWith a 1099 pay stub, you can start taking out loans and efficiently keep records of how much you earn Whether you use a generator or a program like Google Spreadsheets, paycheck proof with a pay

Pay Stub Generator Free Printable Pay Stub Template Formswift

Paystub Generator Us Paycheck Stubs 123paystubs Apps On Google Play

Pay stub maker line free paystub maker tool for your create pay stubs instantly which saves time and money with our automation tool it is online free paystub maker which creates pay stubs to include all pany employee in e and deduction information pay stubs fill line printable fillable blank what is an employee pay stub a pay stub is a piece ofAlso known as payslips, pay advice or even check stubs Thorugh paycheck stubs, employees get to know whether the payment is made or not, they get to know about their salary as well as their deduction, if made It also acts as a proof that a particular amount of payment is made for the services rendered by the employeesA pay stub is that little slip of paper that is attached to a paycheck It allows employees to keep a record of payments received Generally, it looks something like this When an employee receives a paycheck, he or she can free the pay stub from the check and

How To Generate Pay Stub For 1099 Independent Contractors Tech Moths

Free 1099 Pay Stub Template Beautiful 5 1099 Pay Stub Template Contract Template List Of Jobs Templates

Click the Documents icon (1) to view or download your check stubs or copies of your Forms W2 / 1099MISC Click Most Recent (2) to retrieve your most recent check stub or Form W2 / 1099MISC From the Category list, click Check Stub, W2, or 1099MISC to access documents for other check dates or years Select the Include (3) checkbox to choose a documentWith JotForm's free Pay Stub Template, you can automatically generate PDF pay stubs for your employees Simply customize the attached form to match your business needs, input each employees' weekly or monthly wages, and watch as the form converts your submissions in PDF pay stubs — easy to download or print for your accounting records, orIt is simply a measure to verify payment and tax information should you or your employee be audited It's wise to hang onto this document for four years after the employment of a 1099 employee The second document that you may need to provide is the 1099 form This is a document that needs to be sent out if the employee makes 600 dollars or

Online Paystub Generator Online Payroll Maker Free Pay Stub Pay Check Stub Creator Create Professional Pay Stubs Paystubsnow Com

Where Is My 1099 Atbs

21 Posts Related to Free Pay Stub Template For 1099 Employee 1099 Employee 1099 Pay Stub Template Pdf Pay Stub Template For 1099 EmployeeA Pay Stub is an earnings statement that displays a complete breakdown of an employee's current pay It is also referred to as a paycheck stub and check stub If you don't know, firms create a pay stub per pay period for permanent employees while it may be issued occasionally to contractors or freelancers (contract workers of the firm)Confirm their 1099 Type is correct Enter the amount to pay If you also have Accounting, select the expense account for each contractor Click "Review Payroll" to move to Step 2 In Step 2, you will see summaries for both employee and contractor payrolls Click "View Details" at the top to view each check stub detail

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Should Independent Contractors Receive Pay Stub Thepaystubs

What is a 1099 Form?Section Click OK when done Here's an article you can read for more details How to set up contractors and track them for 1099s in QuickBooks Then to print 1099 Go to the File menu select Print Forms and choose 1099s/1096The most common documentation for proof of income includes Pay stub Bank Statements (personal &

Is There An Independent Contractor Pay Stub Paystubcreator

Fha Loan With 1099 Income Fha Lenders

You can also use invoices to provide proof of income if you don't have 1099 forms Create Your Own Pay Stubs If you want an easy way to provide proof of income, you can create your own pay stubs with a pay stub generator This allows you to keep a running income report so you have all the information ready100% MoneyBack Guarantee Complete satisfaction guarantee or your money back Save and Continue Later Almost there!Select Tax1099 menu Click the Company Preferences tab Select Yes in the Do you file 1099MISC forms?

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

Independent Contractor Paystub 1099 Pay Stub For Contractors

Before purchasing your pay stub, you can check the FREE preview and edit your filled pay stub information, after successfully generated pay stub(s), you can download and print Also, you will receive a copy of the pay stub(s) on your provided email address Please use a valid email address to receive a paycheck stub attachment copyThe 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary partiesCreate your own SELF EMPLOYEE instant 1099 employee pay stub in seconds, only require basic information regarding your employment, Now you can generate pay stub with company logo Pay Schedule (How are you paid?) Pay Period YTD Use Pay Period ytd for employees that haven't worked the entire year or to manipulate the employee ytd

Pay Stub Example See What S Included

Free Pay Stub Templates Smartsheet

I make accurate weekly, biweekly, semi weekly and monthly stubs tax calculations and deductions including year to date (YTD)I will calculateCalculate FiverrPay Stub Maker is a widely accepted paystub generator tool whether you want to create pay stubs online for employees or contractors This blog will be a read based on the classification of independent contractors and the way in which pay stub generator can assist Besides being useful for independent contractors, Restaurant staffing issues can also beA 1099 employee is someone who works in a freelance or "gig" capacity They are called 1099 employees because Form 1099 is the form they fill out when making tax returns Workers in many industries, such as content creation, choose to operate as freelancers

How To Print Pay Stubs In Quickbooks Online Nerdwallet

5 Best Payroll Software Solutions For Contractors

Check Stub Generator Our check stub maker gives you its free online paystub calculator tool through which you can carry out all calculations regarding salaries for both, hourly paid and monthly paid employees We constantly update our software with the latest tax rates which ensures accurate calculations To calculate your net pay or takehomeCreate a real paycheck stub instantly by using our paycheck stub generator The paycheck generator is an excellent way to create your paycheck stub quicklyA check stub is a receipt that shows how many hours an employee worked and how much they got paid Here's a pay stub example If an employee receives a physical check, the check stub is attached to the rest of the check via a perforation—just like a ticket stub These days, employees aren't always paid by physical check

What Is The Difference Between A W2 Employee And A 1099 Employee Az Big Media

What Is The Difference Between A W 2 And 1099 Aps Payroll

Complete checkout to receive your PDF without watermarks or restrictions Click Edit Paystub if you still have some editsCreate Your Instant Online 1099 Employee Paycheck Stub Please fill in your employment information in the form below, and INSTANTLY generate your own online paycheck stubs Before purchase your stub, you can review and edit your filled pay stub information, after successfully generated pay stub (s), you can download and printSection 409A deferrals $ 14 Nonqualified deferred compensation $ This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported 15

Independent Contractor Pay Stub Template Luxury 7 Independent Contractor Pay Stub Template Independent Contractor Construction Contract Contract Template

Pay Stub Employee Pay Stub Paycheck Stub Maker

1099 Payroll Center inside Payroll Mate Payroll Software Pay 1099 contractors, 1099 employees, utility companies, tax agencies, suppliers and any other type of payee or vendor Print nonemployee (vendor / contractor) checks, track different types of 1099 payments, manage vendor notes and contact information, view historical transactions, generate reports and printThe 1099MISC form is a form that reports an individual's extra earnings, aside from the salary paid by their employer The employer must generate a 1099MISC form and send it to his employee by January 31st, so that the employee can use it when filling his yearly taxes to the IRS (Internal Revenue Service)Business) Copy of last year's federal tax return Wages and tax statement (W2 and/ or 1099) If you cannot provide a copy of one of the common documents listed above, please see below for a full list of approved documents Income

5 Best Payroll Software Solutions For Contractors

What Does A Pay Stub Look Like For An Independent Contractor Quora

Free Check Stub Maker With Calculator Easy Paystub Maker Online In Usa

1

1

34 1099 Pay Stub Template Free To Edit Download Print Cocodoc

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

Why Use An Online Paystub Generator Form Pros

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

Pay Stub Generator Free Printable Pay Stub Template Formswift

1099 Employee Pay Stub Jobs Ecityworks

3

25 Great Pay Stub Paycheck Stub Templates

How To Make A 1099 Pay Stub For The Self Employed Iowa Media

1099 Pay Stub Template Excel Awesome Pay Stub 1099 Letter Examples Generator For Worker Maker Letter Example Job Description Template Templates

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Free Paystub Generator For Self Employed Individuals

Check Stub Template Printables Pdf Forms Online Try Pdfsimpli

How To Generate Pay Stub For 1099 Independent Contractors Tech Moths

How Can I Hide Social Security Numbers On Payroll Check Stubs

15 Printable Independent Contractor Pay Stub Template Forms Fillable Samples In Pdf Word To Download Pdffiller

Independent Contractor Pay Stub Template Luxury 9 Free 1099 Pay Stub Template Payroll Template Powerpoint Timeline Template Free Templates

How Do I Print A Vendors Direct Deposit Pay Stub

Independent Contractor Paystub 1099 Pay Stub For Contractors

1099 Workers Vs W 2 Employees In California A Legal Guide 21

How Long Should You Keep Payroll Records The Blueprint

What Is The Difference Between A W 2 And 1099 Aps Payroll

27 Free Pay Stub Templates Templatehub

Independent Contractor Paystub 1099 Pay Stub For Contractors

Pay Stub Copy Generator Pdfsimpli

What Information Do You Need Before Creating A Paystub Form Pros

Prepare Paystub W2 1099 940 941 1099 1040 Forms By Shazyyy Fiverr

Adp Paystub Generator Fill Online Printable Fillable Blank Pdffiller

Pay People Properly With This Pay Stub Template Tracktime24

Payroll Checks And Stubs Printed By Ezpaycheck Software

How To Read A Pay Stub The Key Things To Know Florida News Times

Pay Stub Generator Free Printable Pay Stub Template Formswift

What Does A Pay Stub Look Like For An Independent Contractor Quora

18 Pay Stub Template Free To Edit Download Print Cocodoc

How To Make A 1099 Pay Stub For The Self Employed The Daily Iowan

1

How Do I Print A Vendors Direct Deposit Pay Stub

How To Create Paystub For Independent Contractors 123paystubs Youtube

10 Pay Stub Template For 1099 Employee Simple Salary Slip Pay Stub Pay Stubs Template Statement Template

How To Generate Pay Stubs For Truck Drivers And Dispatchers 123paystubs Youtube

1099 Pay Stub Template Excel New Pay Stub 1099 Letter Examples Generator For Worker Maker Templates Words Payroll Template

1099 Contractor Pay Stub Template Jobs Ecityworks

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Payroll Services

Free Online Paystub Generator Generate Pay Stubs Instantly

1099 Vs W2 Difference Between Independent Contractors Employees

The Difference Between A W2 Employee And A 1099 Employee Ips Payroll

Greenshades Employeedesk For Dynamics Gp

How To View Employee Pay Stubs

Free Pay Stub Template Tips Laws On What To Include

What Are The Advantages To Generate The Pay Stub Template Online Pay Stubs Pay Stubs Com

How Do I Generate Paystubs For My Contractors

Free Pay Stub Template Tips Laws On What To Include

Free Pay Stub Template Tips Laws On What To Include

Paystub Sample Templates Thepaystubs

Online Paystub Generator Online Payroll Maker Free Pay Stub Pay Check Stub Creator Create Professional Pay Stubs Paystubsnow Com

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

Online Paystub Generator Online Payroll Maker Free Pay Stub Pay Check Stub Creator Create Professional Pay Stubs Paystubsnow Com

What Is A 1099 Contractor With Pictures

Paystub Generator For Self Employed Fill Online Printable Fillable Blank Pdffiller

25 Great Pay Stub Paycheck Stub Templates

Independent Contractor Pay Stub Template Fill Out Pdf Forms Online

W 2 Form 19 Stub Creator

How Do I Adjust The Pay Stub Template On My Paychecks

Independent Contractor Paystub 1099 Pay Stub For Contractors

How Do I Print A Vendors Direct Deposit Pay Stub

Free Pay Stub Templates Smartsheet

Pay Stub Generator Free Printable Pay Stub Template Formswift

How To Provide Paycheck Proof When You Re Self Employed Az Big Media

Sample Of Pay Stub Information Instant Pay Stub

Free Paystub Creator Create Pay Stubs Online Expressextension

1099 Paycheck Stub Template 35 Images 1099 Pay Stub 7 Exle Pay Stub Pay Stub Format 1099 Pay Stub Template Excel For Your Needs

What Is A Pay Stub Examples And Explanation Fairygodboss

Guide To Creating A 1099 Pay Stub Check Stub Maker

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software